Police warn of investment scams; at least S$32.6 million lost in over a month

Scammers approached victims on social media platforms, messaging apps and the dating platform Coffee Meets Bagel.

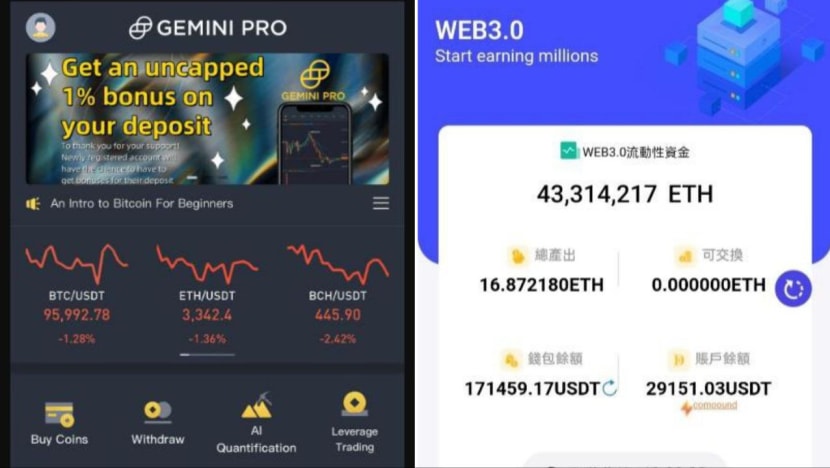

Fake platforms impersonating legitimate trading sites showed "profits" to induce victims to "invest" more. (Images: Singapore Police Force)

This audio is generated by an AI tool.

SINGAPORE: At least S$32.6 million (US$24 million) has been lost to investment scams since January, with about 470 cases reported.

Urging the public to remain vigilant, the police on Tuesday (Feb 11) highlighted how scammers have been targeting victims on Facebook, Instagram, Telegram, WhatsApp and the dating platform Coffee Meets Bagel.

Scammers would build rapport with victims to gain their trust before introducing them to "investment opportunities", which would sometimes involve cryptocurrencies.

Victims would be asked to open accounts at crypto exchanges and transfer money into the accounts to purchase cryptocurrencies.

They are then tricked into transferring the cryptocurrencies to fraudulent cryptocurrency trading platforms or the scammers' own wallets.

In some cases, victims would initially receive small profits from the scammer to induce them to continue investing.

Fake websites or applications displaying a purported rise in profits would also lead victims to invest larger sums, the police said.

FAKE INVESTMENT ADVERTISEMENTS

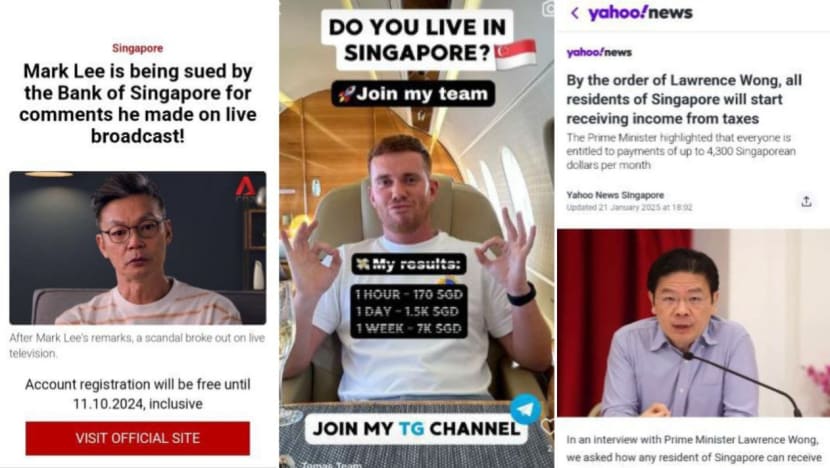

In other cases, victims are reeled in by fake advertisements on Facebook or Instagram featuring supposed "endorsements" from political figures or celebrities on an investment. Some of these ads impersonate news outlets like Yahoo News or CNA.

The fake ads would lead victims to a messaging platform to contact the scammers. In some cases, victims would be prompted to provide their personal particulars - such as contact details and card details - in order to register for an account on a fraudulent trading platform.

"These victims would then receive phone calls or messages from scammers posing as staff from investment companies or brokers," said the police.

Scammers would also add potential victims to chat groups or channels on apps like Telegram. To dupe them into thinking that an investment was authentic and profitable, scammers would associate themselves with famous individuals or reputable companies or have other "members" in the chat group attest to the profits they made from the investments.

When contacted, scammers would offer various investment plans to victims and ask for their personal information.

Victims would contact the scammers who would then offer them various investment plans and ask for their personal information to join the “investment”. To reinforce the deceit, scammers would also use fake websites or applications to show "profits".

Most victims would only realise that they had been scammed when they could not withdraw their "profits" despite transferring increasingly large sums of "fees incurred" for the investment.

Scammers could also suddenly become uncontactable.

The police advised the public to take precautionary measures such as installing the ScamShield mobile app and checking for scam signs by calling the 24/7 ScamShield Helpline at 1799.